rsu tax rate calculator

Vesting after making over. Vesting after making over 137700.

Rsu Taxes Explained 4 Tax Strategies For 2022

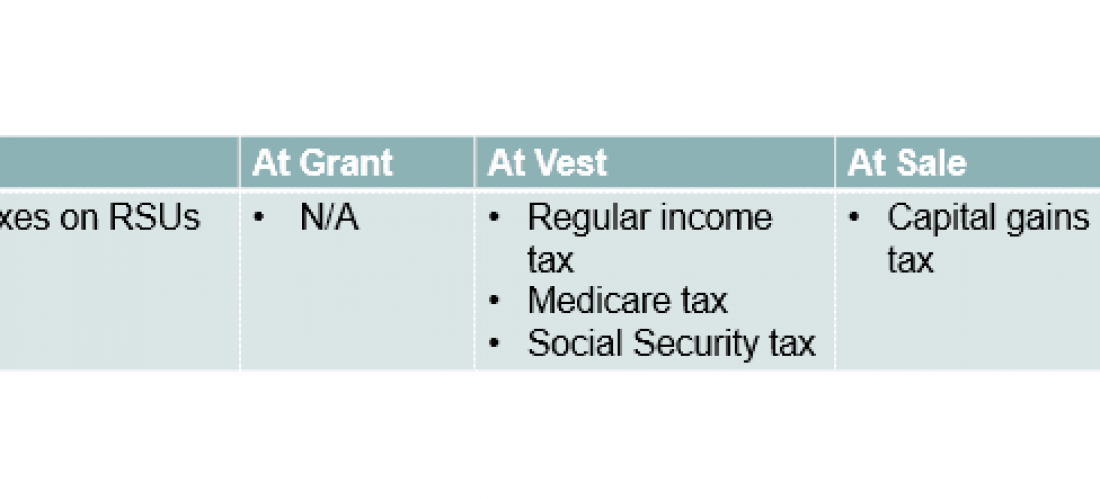

When you receive the shares you must pay taxes on gains or.

. Compare how the total payout may change between options and RSUs. Quickly learn licenses that your business needs and. Let us understand tcs tax.

Vesting after Medicare Surtax max. Basic Info for RSU Calculator. Vesting after Social Security max.

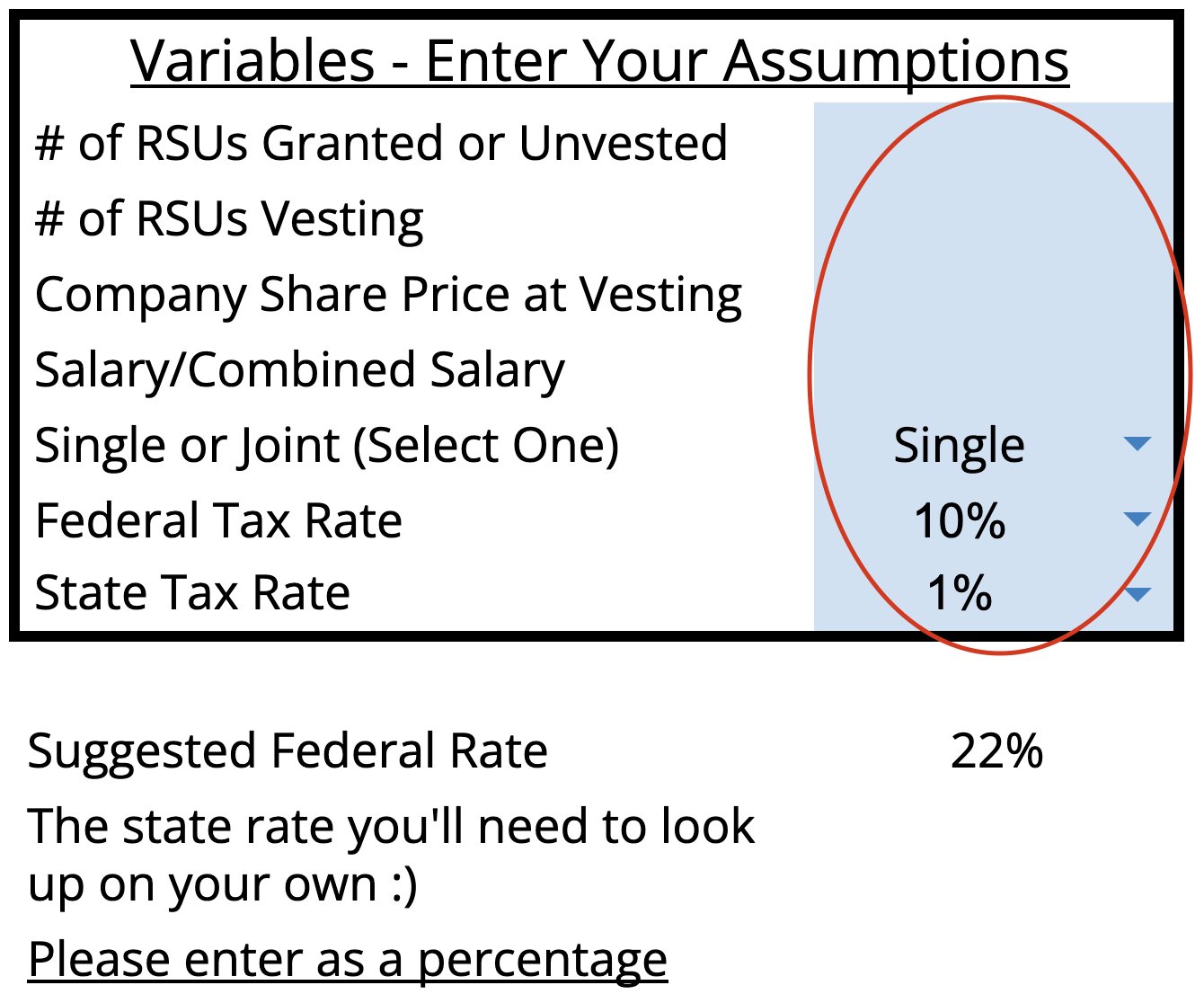

The of shares vesting x price of shares Income taxed in the current year. Restricted Stock Units RSUs Tax Calculator. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

The beauty of RSUs is in the simplicity of the way they get taxed. Apply more accurate rates to sales tax returns. Ad Thinking of switching from stock options to RSUs restricted stock options.

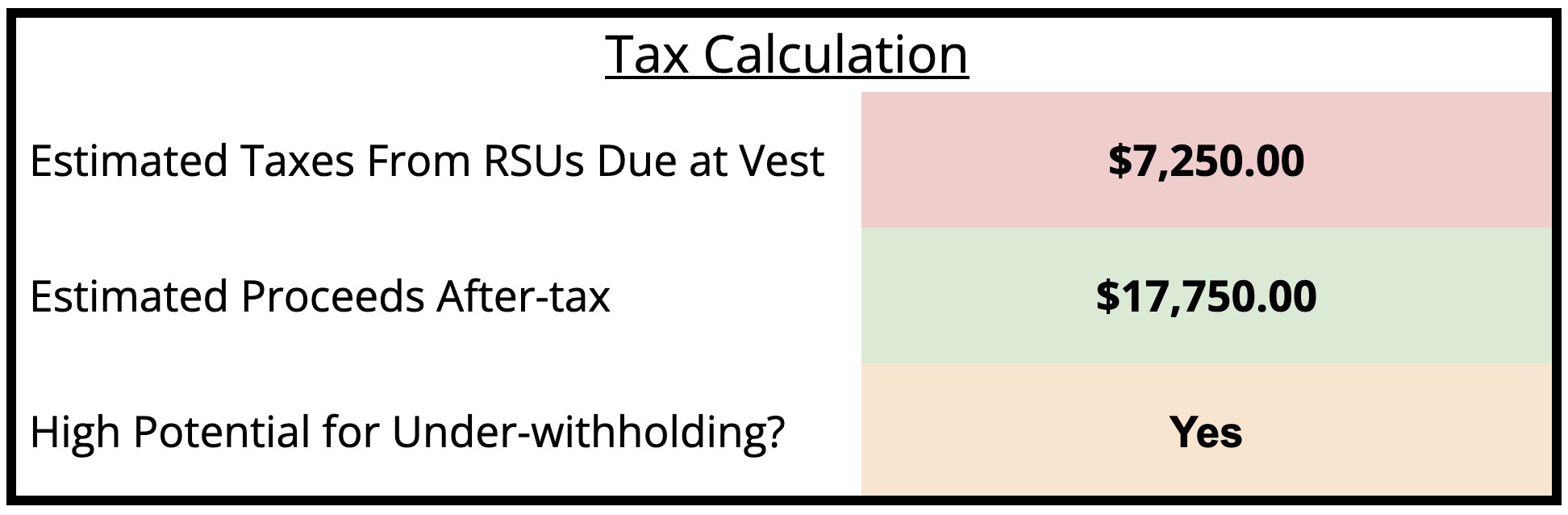

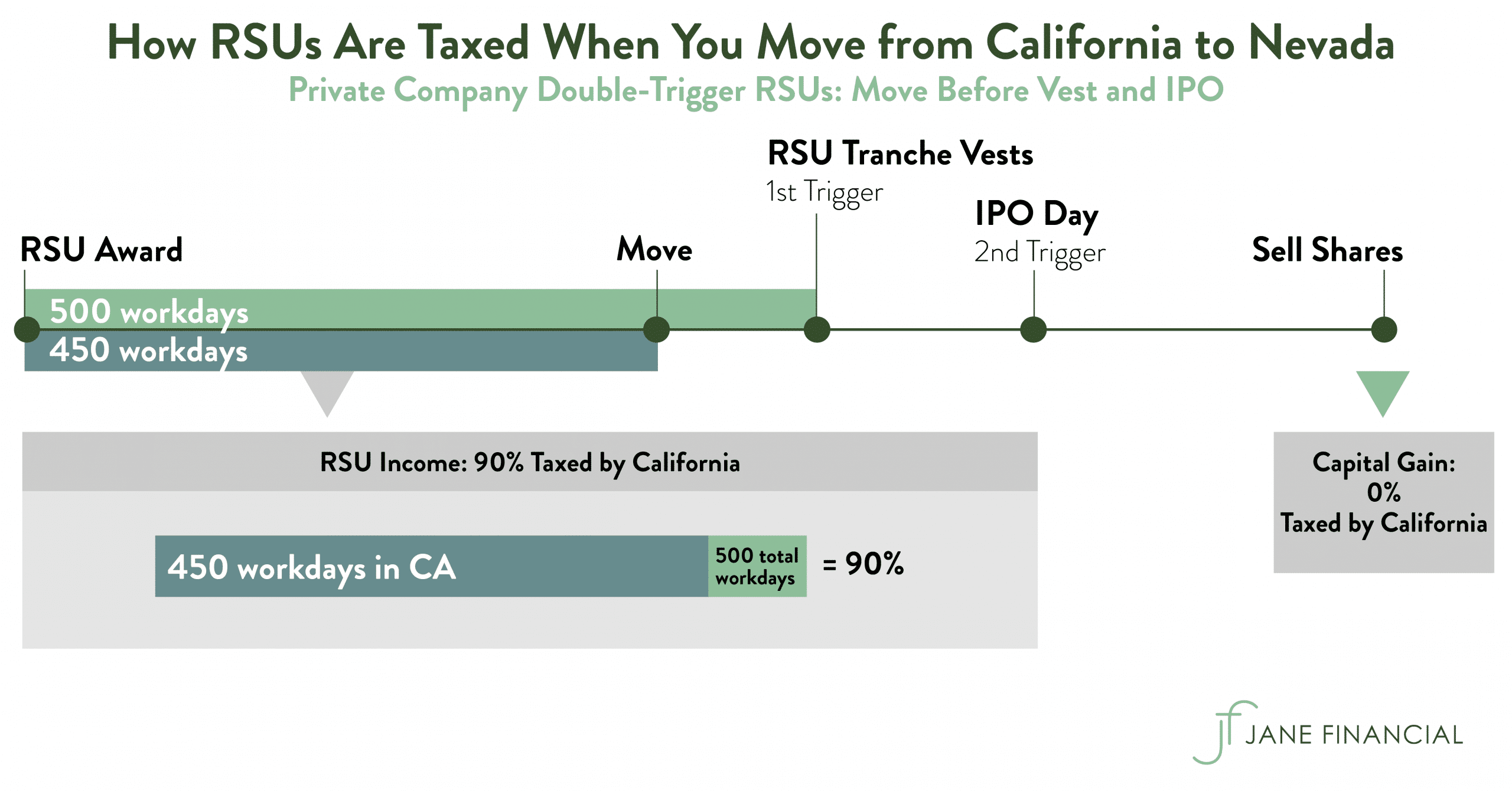

This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax. If held beyond the vesting date the RSU tax when shares. Vesting Schedule Hypothetical Future Value Per Share.

Unlike the much more complicated ESPP they get taxed the same way as your income. Enter the amount of your new grant whether an offer grant or an annual refresh. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Get information about sales tax and how it impacts your existing business processes. This is the total of state county and city sales tax rates. Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax.

RSUs are taxed as W-2. To use the RSU projection calculator walk through the following steps. This is different from incentive stock.

When you receive RSUs you can approximate the value of the grant by multiplying the number of RSUs and the closing stock price on the date of grant. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

RSU tax at vesting date is. The of shares vesting x price of shares Income taxed in the current year. If you live in a state where you need to pay state.

The minimum combined 2022 sales tax rate for Riverhead New York is 863. Our Premium Calculator Includes. The New York sales tax rate is currently 4.

The IRS does not consider restricted stock units RSUs to be tax-deductible when compared to stock options. Value of Your Restricted Stock Units. How Are Restricted Stock Units RSUs Taxed.

Feb 08 2022 amazons rsus currently vest 5 after the first year 15 after the second and then 20 every six months for the remaining two years. Choose your province or territory below to see the combined.

Rsu Taxes Explained 4 Tax Strategies For 2022

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Stock Options Vs Rsus What S The Difference Thestreet

Restricted Stock Units Jane Financial

Equity Compensation 101 Rsus Restricted Stock Units

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Calculator Projecting Your Grant S Future Value

Restricted Stock Units Jane Financial

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana